Decisions are the most crucial part of advancing a project. Without them, ideas lie in-acted upon, development stalls, and instead of progress there is stagnation. The Bismuth Foundation is well aware of the dangerous path of inaction, and has always committed a full effort towards advancing the platform at a steadfast pace. One such large advancements have come into fruition recently, with the conclusion of Bismuth’s first Governance Vote- BGV-01.

BGV-01 was a motion that combined a new and revolutionary governance protocol with branching decisions that would impact Bismuth on a grand scale – retain the current emission schedule (option A), or significantly reduce it (option B). Throughout October 1st and November 1st of 2019, Bismuth stakeholders could vote on either choice.

The results were resoundingly in favor of an inflation cut – option B, with a weight of over 89%, with the remainder 9.5% in support of option A and 1.5% choosing neither. A grand total of 68,952 Bismuth was committed to voting in BGV-01, an extraordinary figure proving the community’s willingness to partake in such motions.

From block 1,450,000, BGV-01 option B will be implemented to vastly lower inflation and supply dilution.

With Option B the annual inflation per year starting from block height 1,450,000 would be:

| Year 1 | 19.4% |

| Year 2 | 14.9% |

| Year 3 | 11.7% |

| Year 4 | 9.4% |

| Year 5 | 7.6% |

| Year 6 | 6.1% |

| Year 7 | 4.9% |

| Year 8 | 3.8% |

| Year 9 | 2.9% |

| Year 10 | 2.0% |

Implications:

- For holders: less dilution, one of the components of the sell pressure goes down.

- For Hypernodes owners: no immediate change in the rewards, but on the long run Hypernodes rewards will decrease.

- Still, because of the dilution drop, the Hypernodes yield in the beginning will be higher than the overall dilution rate.

- For miners: reduction of rewards short term, but more rewards after some time (block height 5,300,000).

- For dApps: no changes to fees or block times.

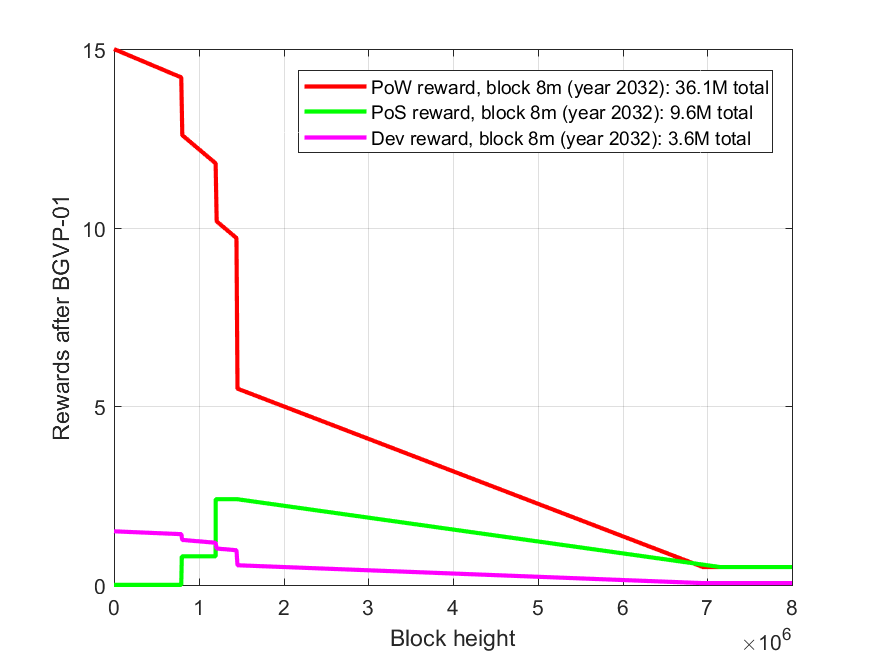

The new graph showing the miner, hypernode and dev rewards are shown below. In addition to the reduced emission, lower limits of 0.5 BIS have been put in place for both the miner and hypernode rewards. Since the dev reward is 10% of the miner reward, the lower limit on those will be 0.05 BIS per block. The lower limit will be reached at approximately block height 7,100,000.

Bismuth’s first governance vote was a great success, and the community has spoken to alter Bismuth’s emission schedule for the better. Not only has a major change been decided upon, but it has proven that the BGV protocol is a far more viable and effective voting mechanism compared to what other platforms have created.

All exchanges, pools and hypernode operators need to update their nodes by block height 1,450,000 which is expected to take place on November 27, 2019. The new release will be available here.